Did you see last week that the City Manager wanted to charge every house and business in El Paso a monthly fee to fix the streets? From ElPasoMatters.com:

The El Paso City Council on Monday was to hear a proposal from the city’s Capital Improvement Department to implement a monthly fee for residents and businesses citywide to create a dedicated fund for street repairs – a basic service city leaders for decades have struggled to adequately fund.

But the so-called transportation user fee was deleted from the agenda in a 5-3 vote without discussion or a presentation from city staffers who put the policy proposal together. The proposal wasn’t up for a vote, but the discussion was meant to be the first in a series of meetings and public presentations before a vote on whether to implement it took place in March.

The fee was pitched by city staffers as a way to create a dedicated revenue source specifically for road maintenance and repair, which City Manager Dionne Mack has consistently said is underfunded by tens of millions of dollars annually.

The City is happy to stick it to the taxpayers, but only some of the taxpayers. The City is actually leaving a bunch of tax money on the table, or, more precisely, in the hands of real estate developers and speculators and their cronies.

Remember back in 2012, when El Paso had just enjoyed two years of robust growth, and City Council was corrupted by some “visionary” real estate speculators who believed that no expense was too great for El Paso taxpayers for “economic development”?

The City, with the enthusiastic backing of disgraced City Manager Joyce Wilson, started creating Tax Increment Reinvestment Zones.

TIRZs are designed to incentivize the development of blighted areas.1 In El Paso TIRZs have been weaponized to hedge the bets of real estate speculators.

(I don’t want to rehash all the facts about TIRZs, but you can find out a lot about TIRZs in general, and El Paso’s TIRZs in particular, by perusing this series of articles here. Or, if you want the TLDR version, you can find that here.)

TIRZs get to keep any increase in taxes on taxable values in the TIRZ. That means that money doesn’t go into the City’s General Fund to pay for public safety, or City salaries, or street maintenance.

Or street maintenance.

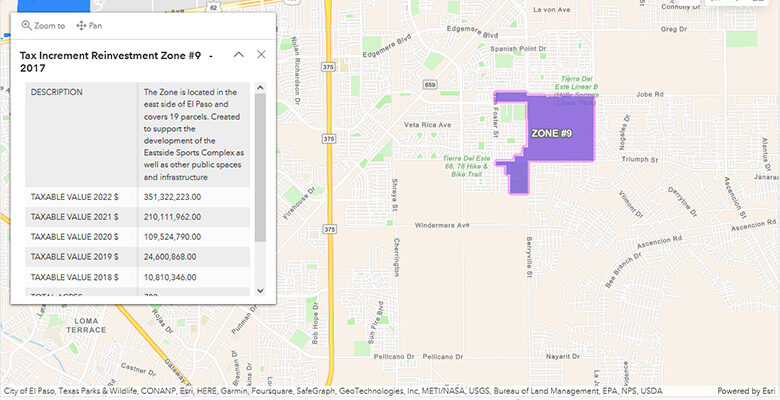

Here’s an example (from your favorite website):

TIRZ 9 is out there by the Eastside Sports Complex. In 2017, the Taxable Value of the land in TIRZ 9 was $10,810,346. In 2022, the Taxable Value of the land in TIRZ 9 was $351,322,223. That’s taxes on $340,511,877 worth of improvements that’s staying out there by the Eastside Sports Complex, for the benefit of the residents (and the land developers) out there.

From 2020 to 2023, the property value of all those TIRZs increased by $665,880,515. That’s $665,880,515 worth of property for which the taxes didn’t go into the City’s General Fund. At the 2024 City tax rate of .761405, that’s worth $5,070,047.54 (five million, seventy thousand, forty-seven dollars and fifty-four cents) a year.2 And that’s just till 2023. I’m sure property values have appreciated since then.

Bang. That’s more than half the ten million dollars a year that the City claims it needs to maintain our streets.

(Check my math. I dare you.)*

The City can cancel those TIRZs. They can modify them. They have that legislative power. Establishing those TIRZs was kind of shady to begin with, because TIRZs are designed to incentivize the development of blighted areas. In El Paso TIRZs have been weaponized to hedge the bets of real estate speculators.

I’m just saying. If the City is willing to ask every house and business for a little more, maybe it’s time to take another look at those TIRZs.

*I checked my math and I was off by magnitudes, so I fixed it. I forgot how percentages work.

Yeah, but the fix is permanently in, isn’t it? The only way to dump this stuff is to vote in an entirely new Council.

Yes the TIRZ tool has been misused because it has been placed in the wrong areas, the areas where the oligarchy has wanted them. They should be created in deteriorating areas that desperately need investment.

The other taxing entities are not exempt, just the city portion. So EPISD, UMC and the County still get their tax unless I am mistaken. That is, they did not vote to give up their tax base in the TIRZ. The city can and has rescinded TIRZs but in some cases like #13 (Foster’s NE barony) and #5 (DMD) would find itself liable to contract default in that the parties to the TIRZ invested in good faith on the premise of the TIRZ terms.

What I wonder about is who is minding the TIRZ chickens to assure that the counter parties are holding up their obligations?

I’m not so sure, Jerry. Who would sue? The boards of the TIRZs, who are appointed by the same City Council that would presumably roll the TIRZs back? Recent decisions by chief executives argue that the boards could be brought to heel with judicious appointments.

The Downtown Management District is a separate entity from TIRZ 5, though I imagine there’s a lot of overlap. The DMD charges business owners its own tax (currently $0.0012 per $100 valuation). I’m sure they’d grumble about losing a revenue source, but I imagine they’d have to lump it.

TIRZ 13 is covered by its own Municipal Utility District, which has its own taxing jurisdiction. That lets the developers lowball house prices and make it up in taxes. It’s a sweet deal if you can get it, and they got it.

Someone smarter than I am could probably figure it out, if they were willing to poke the bear. There are not too many people in El Paso willing to poke the bear.