Part of the reason that property taxes are so high in the City of El Paso is because not everyone has to pay them. Lots of the new projects that the City brags about were covered by Tax Incentives. And a lot of those projects were located in Tax Increment Reinvestment Zones.

In a TIRZ, the tax derived by any increase in property values stays in that TIRZ. If I have a $100 property and over a year that property doubles in value, the City’s General Fund still gets the property tax from the original $100 property valuation, but the tax on the increase in valuation goes to the TIRZ. None of the taxes on the increased valuation goes to the City’s General Fund, the pool of money that the City uses to pay for public safety, or street repairs, or the salaries of our elected officials and the bureaucrats, all of whom have a hand in creating TIRZs.

TIRZs are designed to rehabilitate areas that won’t rehabilitate themselves. Here’s the Texas Tax Code, Sec. 311.005, that defines the criteria for Reinvestment Zones.

Sec. 311.005. CRITERIA FOR REINVESTMENT ZONE.(a) To be designated as a reinvestment zone, an area must:(1) substantially arrest or impair the sound growth of the municipality or county designating the zone, retard the provision of housing accommodations, or constitute an economic or social liability and be a menace to the public health, safety, morals, or welfare in its present condition and use because of the presence of:(A) a substantial number of substandard, slum, deteriorated, or deteriorating structures;(B) the predominance of defective or inadequate sidewalk or street layout;(C) faulty lot layout in relation to size, adequacy, accessibility, or usefulness;(D) unsanitary or unsafe conditions;(E) the deterioration of site or other improvements;(F) tax or special assessment delinquency exceeding the fair value of the land;(G) defective or unusual conditions of title;(H) conditions that endanger life or property by fire or other cause; or(I) structures, other than single-family residential structures, less than 10 percent of the square footage of which has been used for commercial, industrial, or residential purposes during the preceding 12 years, if the municipality has a population of 100,000 or more;(2) be predominantly open or undeveloped and, because of obsolete platting, deterioration of structures or site improvements, or other factors, substantially impair or arrest the sound growth of the municipality or county;(3) be in a federally assisted new community located in the municipality or county or in an area immediately adjacent to a federally assisted new community; or(4) be an area described in a petition requesting that the area be designated as a reinvestment zone, if the petition is submitted to the governing body of the municipality or county by the owners of property constituting at least 50 percent of the appraised value of the property in the area according to the most recent certified appraisal roll for the county in which the area is located.

It’s hard to see how any of the City’s TIRZs qualify.

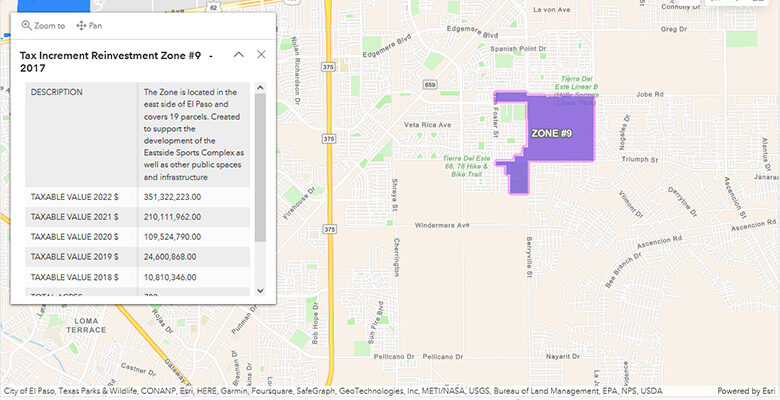

Here’s a great website that shows you where all the City of El Paso’s Tax Increment Reinvestment Zones are.

If your blood pressure is a little low today, maybe you should check it out.

All of the areas where the City is putting its (our) resources are covered by Tax Increment Reinvestment Zones.

Downtown? TIRZ 5.

The Medical Center/Hospital District? TIRZ 6 and 6a.

TIRZ 9 is out there by the Eastside Sports Complex. In 2017, the Taxable Value of the land in TIRZ 9 was $10,810,346. In 2022, the Taxable Value of the land in TIRZ 9 was $351,322,223. That’s taxes on $340,511,877 worth of improvements that’s staying out there by the Eastside Sports Complex, for the benefit of the residents (and the land developers) out there.

That’s almost $3 million a year that is not going into the General Fund. That’s an extra $3 million that El Paso property owners had to cover in the General Fund for those developers.

(Can somebody check my math? I haven’t had my coffee.)

And that’s just one TIRZ.

For a little more than the last 10 years, El Paso taxpayers have been subsidizing the financial dreams of developers.

Will the new City Council rectify this injustice?

We’ll see.

We are being taken to the cleaners, and it has been going on too damn long. If only we could get El Paso voters to take an interest in what is going on.

I am happy to see the return of El Chuqueño blog. Rick, your insight and humor have been missed.