That’s the teaser on the El Paso Times landing page today. If you click on it, the story is headlined El Paso’s property tax rate is among the highest in the nation. Here’s why.

A higher appraisal might be good news for owners who plan to sell their homes. A higher appraisal for those who plan to stay put means footing a higher tax bill in a city with one of the highest property tax rates in the nation. El Paso has the second highest property tax rate among the 50 largest cities in the U.S., according to a joint study by the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence. Detroit ranks as No. 1.

. . .

El Paso’s property tax rate for homeowners within the El Paso Independent School District went up 21% in the last decade. The property tax revenue collected from those rates, which is split among five different taxing entities, rose nearly 70% to roughly $326 million since 2011.

The Lincoln Institute’s Property Tax study puts El Paso’s effective tax rate for homeowners at 2.67%. That means a home worth $100,000 will pay $2,670 in taxes. The effective tax rate, as calculated in the study, bakes in various factors, such as homestead exemptions, that impact the final tax bill. This makes comparing rates among cities and states with different tax structures more accurate. In 2020, the average effective tax rate among the 50 largest cities in the U.S. was 1.40%.

. . .

One reason El Paso’s tax rate is the second-highest among big cities is that its median home value is among the lowest. You can buy roughly the same size and quality house in El Paso for cheaper than you can in cities such as Albuquerque, San Antonio or Tucson. In the study, El Paso is tied with Milwaukee for the third-lowest median home value at $133,600.

Given the red-hot real estate market, the Greater Association of El Paso Realtors sets a higher median price of $197,250 for a single-family home in El Paso. Their value is as of May 2021, while the Lincoln Institute’s value is from 2020.

. . .

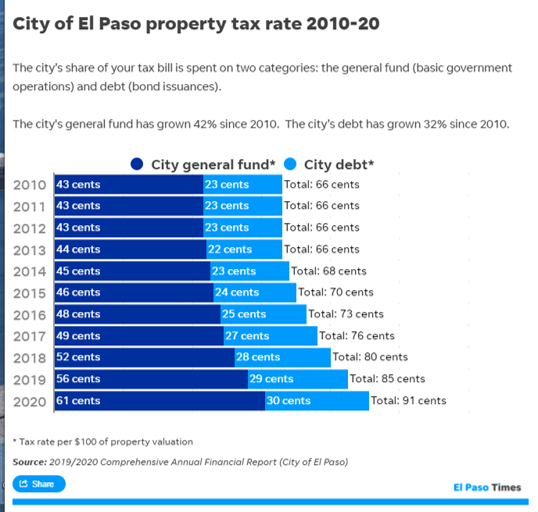

The second-largest share of the tax bill [after school districts] goes to the city of El Paso, which is also the taxing entity with the second-fastest-growing tax rate. In the last decade, the city’s tax rate has gone up 39% from 63 cents in 2010 to 91 cents in 2021. The total property tax rate for residents living within EPISD’s boundary is $3.07. This is the actual tax rate applied to every $100 in property valuation. The actual tax rate doesn’t account for exemptions, as the effective tax rate does in the Lincoln study.

The report’s author, Monica Ortiz Uribe, also includes this helpful chart:

I think it’s great that the El Paso Times is finally looking into the City’s fiscal policies. But the horse has already left the barn.

The short version of why the City’s share of our property taxes keeps rising is because our elected officials keep borrowing money for things we don’t need and can’t afford.

Look at that chart up there. 2010, 2011, right on through to 2013, we keep on clicking at 66 cents per hundred dollar valuation. Then bang, 2014, the City hires Tommy Gonzalez as City Manager. City Council starts whining that they want their Quality of Life projects. Mr. Gonzalez complies. There’s not a fiscally responsible adult in the room, or at least never a majority on the dais.

And our local media turned a blind eye to the whole fiasco. If property valuations hadn’t skyrocketed this year, the El Paso Times would still by eating ice cream and catching another ride on the merry-go-round.

I’ve got an idea. Let’s start electing fiscally responsible candidates to serve on City Council. Let’s start demanding better from our local print media. Let’s start sharpening the pitchforks, and get the torches ready.

I can dream, can’t I?

So we’ve been told and some choose to believe it

I know they’re wrong, wait and see

Someday we’ll find it, the rainbow connection

The lovers, the dreamers and me

And the guy that mainly let it happen now runs a site called “El Paso Matters”

Hahaha