According to this story in the El Paso Times, the proposed budget for next year requires a increase in property taxes.

City Manager Tommy Gonzalez on Tuesday presented a proposed city budget of $904 million for the next fiscal year that would require a tax increase of $56 on the average home – a proposal the mayor said he would veto.

. . .

The proposed budget represents an increase of about 7 percent, or $59 million, over last year. It includes pay increases for firefighters approved by voters in May 2015, costs to cover bond projects and their maintenance, employee pay increases, new positions, animal services reforms and more. The proposal includes employee pay raises of between 1.5 percent to 2.5 percent depending on their current salaries.

Under that proposal, the city would have to increase the tax rate by 3.86 cents per $100 property valuation, which translates to about $56 more a year on a home with the average valuation of $127,590. Senior citizens and the disabled would still be eligible for an additional property tax exemption implemented last year.

According to Brutus over there at ElPasoSpeak, that tax increase could make us the city with the second highest property tax rate in the U.S.

After seeing that El Paso had the third highest residential property tax rate of America’s 50 largest cities in 2015, we set off to find out what it would take to get to number two or even to number one, the highest.

Milwaukee Wisconsin had the second highest rate in 2015 at 2.675%. El Paso was third at 2.640%.

That means that our tax rate only needs to go up three and one-half hundredths of a percent to tie with Milwaukee.

That doesn’t include the increase in our electric rates, or water rates, or the price of natural gas.

And it seems like every other taxing entity in the county, including the County itself, will also be jacking us for a tax increase next year. The Children’s Hospital debacle will need to be paid for, and the doctors at UMC probably need new stethoscopes. And we can’t let the El Paso Community College go hungry.

The Ysleta ISD just got a new bond issue passed, and the El Paso ISD is asking for one to deal with their declining enrollment. I’m not sure how that works out, but they’ve hired the City’s former Chief Financial Officer, and I’m sure that she can explain how more taxes will actually save us money, or something like that.

You better tighten your belt while you’ve still got one. I understand subsistence farming is a good business to get into.

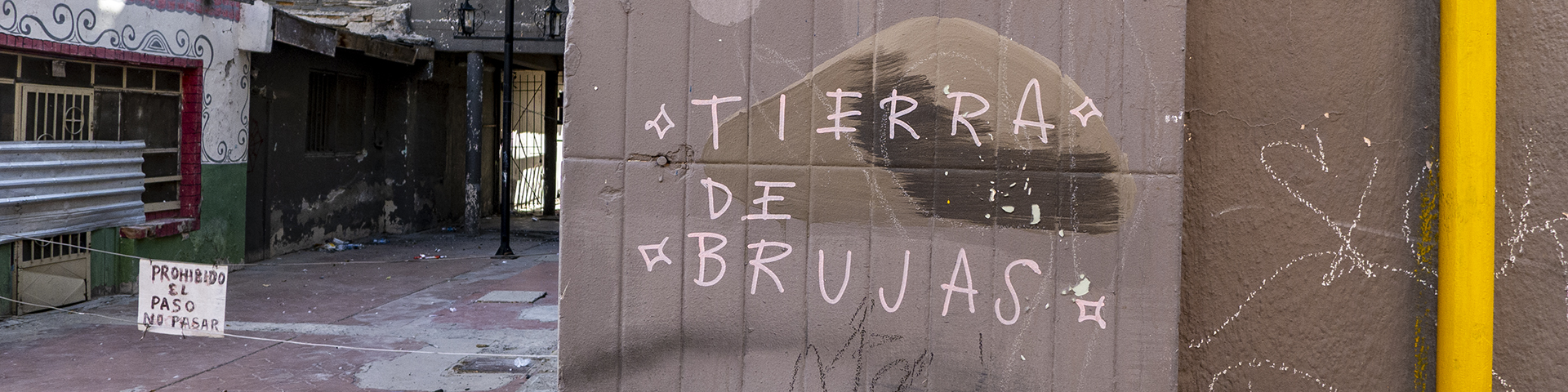

Other Texas cities have a booming job market, lower taxes, much better public services and lall those quality of life amenities (longstanding in most cases) that our local leadership so wants to emulate. Oh, and some pretty terrific schools. Yes, none of them have that unique special chafa and very brown vibe, but the leadership disdains that. So why would we pay extra to get screwed? Seems the bran drain is more like a drill.

TAXES defy the law of Gravity as they always go UP and never down. No surprise here..nothing to see…keep moving along.