In a recent guest column at ElPasoTimes.com, Representatives Hernandez, Salcido, and Rodriguez wrote the following:

The city of El Paso has not increased property taxes since 2020, and for the upcoming budget, the city is recommending a significant property tax rate reduction. This year, the City Council will be reducing taxes and providing a saving for all residents by reducing the budget by millions.

Haven’t you paid more in property taxes for the last two years?

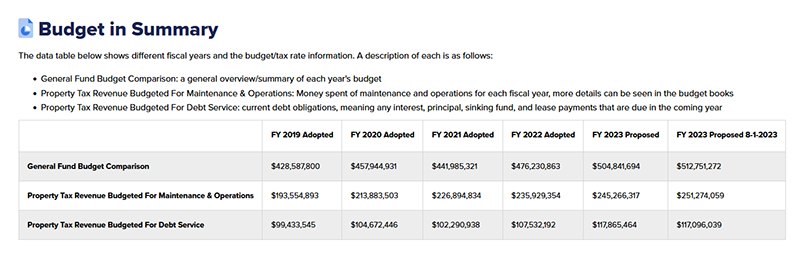

Since 2019, the City’s General Fund has increased by more than $76 million, despite actually decreasing by $16 million in the year handicapped by the plague.

The single largest source of revenue for the General Fund is property taxes. The General Fund gets about 40% of its money from property taxes

(Curiously, the City’s website features this Budget in Summary which shows that the General Fund budget actually increased by $7 million from the FY 2023 Proposed to the August 1 revision.

Those Representatives’ Guest Column was published on August 1. Do you think there’s a chance that they don’t know what they’re talking about?)

And here’s City Manager Tommy Gonzalez’ take on the budget, from a story at ElPasoTimes.com:

“Our leadership team has implemented annual financial mechanisms that pay for police and fire needs, streets, parks improvements, and equipment replacement,” Gonzalez said in the news release. “We have also been able to grow our financial reserves. But most importantly, we have listened to our resident and to our small businesses who continue to face economic challenges due to the lingering effects of the pandemic.

“This is why we are recommending almost $20 million less in the city’s budget,” Gonzalez added. “We believe this tax relief will help our taxpayer and continue our efforts to fully recover as a community.”

Isn’t that funny. Here’s the legally mandated statement from the Proposed FY 2023 Budget Book:

This budget will raise more total property taxes than last year’s budget by $21,316,148 or 6.0%, and of that amount $4,392,638 is tax revenue to be raised from new property added to the tax roll this year.*

Isn’t that funny. The proposed budget book shows a increase in property taxes of $21 million, and yet the City Manager says the City is recommending $20 million less in the City’s budget.

Do you think he looked at it from the wrong end of the telescope?

I’m no accountant. But last year’s adopted budget was $1,067,475,828, and this year’s proposed budget is $1,161,899,434. Now, I am a product of the public schools, but isn’t $1.16 billion bigger than $1.07 billion?

This is from a paragraph four paragraphs above Mr. Gonzalez’ signature in the FY 2023 Proposed Budget Book:

“The FY 2022 – 2023 All Funds Budget of $1.16 billion shows an increase of $94.4M from the prior year.”

Curious, isn’t it, that the City Manager says they’re recommending almost $20 million less in the city’s budget? What’s he talking about?

*(Due to the magic of compound interest, if the City’s budget increases 6% every year, the budget will double in 12 years.)

Rich, can’t wait for you to be on the city council so you can call out these clowns who keep lying to the people.

Rich, keep on keeping us Informed. I certainly appreciate it. City Hall has lost it.

Rich thanks for the info, these reps (puppets) have no idea on how to run the city. They all should be terminated.