A lot of people have been saying that El Paso has the second highest homestead tax rate in the country, second only to Detroit.

But Detroit has assessment limits on properties. El Paso doesn’t.

From TaxFoundation.org:

Assessment limits typically impose a constraint in the rate of growth of assessed value, stipulating that annual increases cannot exceed a given percentage (or, sometimes, a certain amount above inflation) unless the property is sold, transferred, or significantly altered.

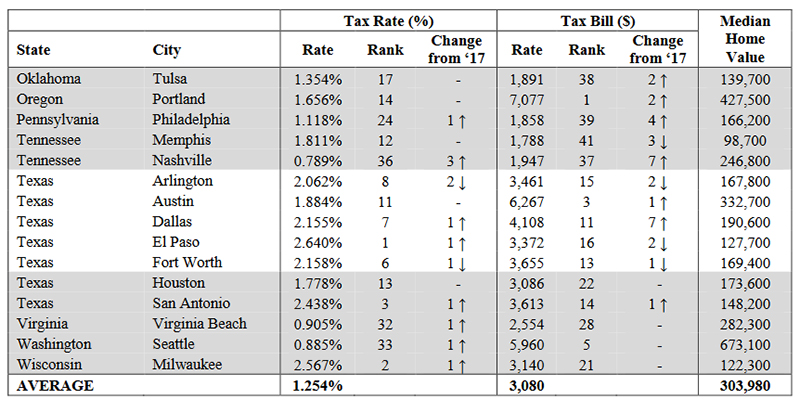

When you include Detroit’s assessment limits, Detroit slips to fourth in the rankings. El Paso soars to Number 1!

All this data is from 2018, compiled by the Lincoln Land Institute and released in June, 2019. Our current tax rate is now bumping up against three percent.

In the tax ratings we’ll be figuratively looking at Detroit in the rear view mirror, much the way many of our fellow El Pasoans are literally looking at El Paso.

Oh hell.