Brutus over there at ElPasoSpeak makes some good points with deeper implications, in this post titled EPISD bonds-story changes again.

Back in EPISD bonds–the story changes we pointed out that EPISD officials were saying one thing to the newspaper and another to the bond advisory committee.

Using the same slide and reading the December 20, 2016 bond order we can see yet another instance where they have failed to tell the whole story.

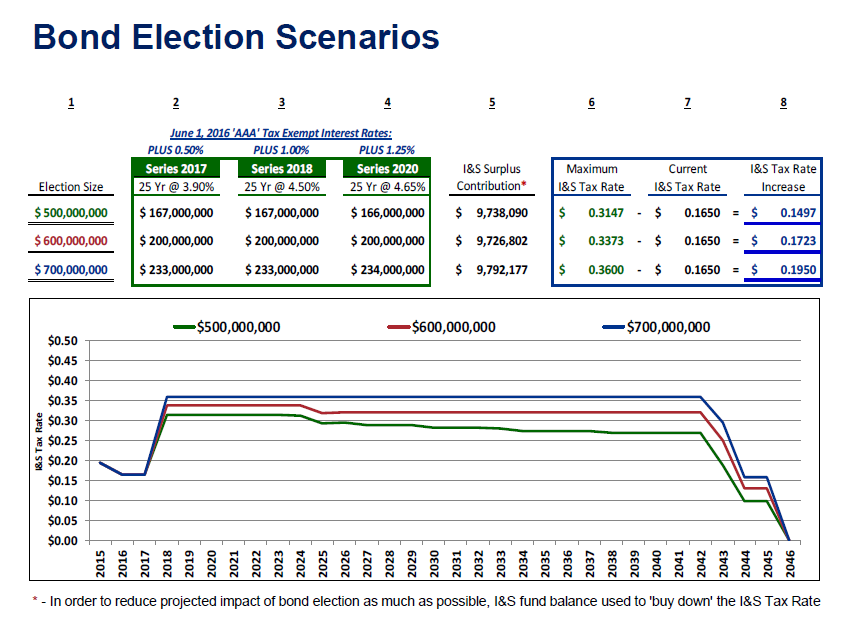

The chart below shows their plan to issue bonds in 2017 at 3.9%.

According to the December 20, 2016 bond order “the maximum true interest cost of the Bonds shall not exceed 5.00%”.

Further, the chart shows numbers assuming a “AAA” interest rating. According to a recent article in the Times, Standard and Poors has the district at an “AA-” rating and Fitch just upgraded the district to “AA”.

The district authorized both the superintendent and the deputy superintendent of finance and operations (aka “fuzzy math lady from the city”) to sell the bonds.

Well, that’s bad. It looks like those nice people who sold us a $669 million bond lied to us to do it.

But the bigger implication is this: They didn’t expect anyone to notice. That means they were banking on the incompetence/collusion of the local press.

If we expect the citizens to wake up from their stupor, they need to be informed. Our elected officials need to be held to task, and bloggers shouldn’t be the ones responsible for finding the truth.

I know readership is dwindling. Budgets are shrinking. But you know what sells newspapers? Controversy.