Rising property taxes don’t help small businesses. And all these vanity projects aren’t making the pie any bigger.

Where is the Economic Development that the Quality of Life bond proponents promised us? Where are our expanding markets?

According to estimates from the U.S. Census Bureau, the population of the City of El Paso declined from 2017 to 2018, the latest year for which estimates are available.

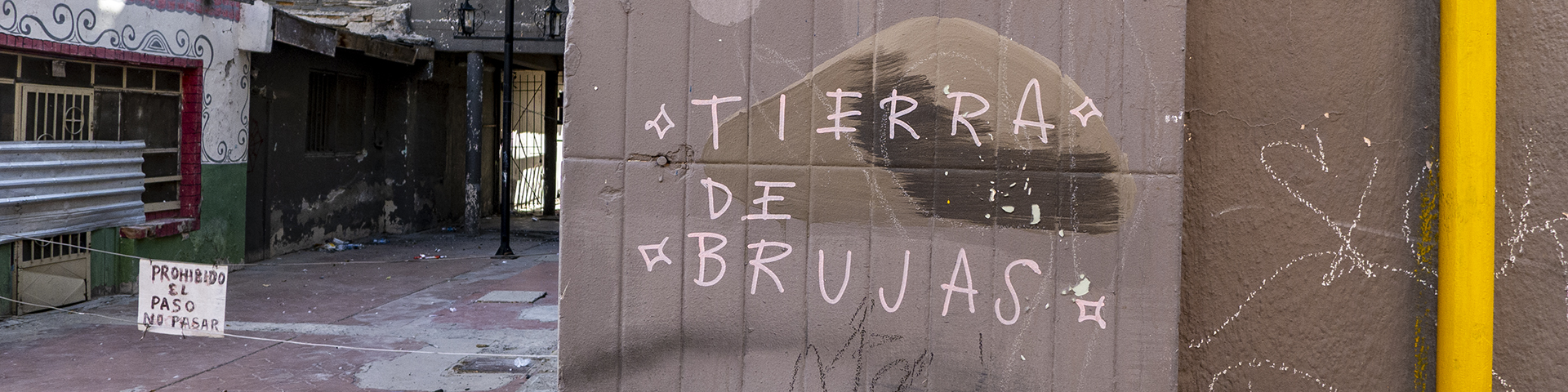

The City touts a (questionable) Downtown Renaissance, but, with no increased overall economic activity, that’s just taking money from the cash registers of any business that isn’t downtown. And those outlying businesses are stuck with a rising tax bill to finance those public downtown projects, and the private developments downtown are subsidized with tax incentives. So that small business owner on Montana, or Alameda, is hit with a rising tax bill to take up the cost of providing public services for those subsidized private businesses.

(Drive down North Mesa and look at the ever-increasing number of empty storefronts on that street.)

You’d think that the El Paso Chamber of Commerce would stand up for small businesses, but the Chamber is in the pocket of the local millionaires who benefit from the tax incentives.

The truth is that the City of El Paso is picking winners and losers. El Paso businesses don’t get an even playing field. If you’re rich, well-connected, and donate heavily to political campaigns, you get tax incentives for your private projects and you get public projects that benefit your interests. And if you’re a small business owner in El Paso, you get to subsidize those tax incentives and public projects. Indirectly, you’re even subsidizing the campaign contributions.

Which side of the equation are you on?